The Dotdigital Blog

Featured posts

Customer-first marketing

View all-

Customer data

Customer dataThe DPDI Bill: What this means for marketers

Read moreDiscover how the DPDI Bill impacts the UK marketing landscape and learn to adapt your strategies for success in this comprehensive guide.

-

Customer data

Customer dataThe power of preference centers

Read moreDiscover how preference centers can drastically improve your email marketing strategy by respecting customer data privacy, offering personalized experiences for maximum engagement, and conversion.

-

Customer data

Customer dataDotdigital’s 2023 releases wrapped up: what’s landed this year

Read moreExplore Dotdigital's top 5 releases for 2023 including WinstonAI, unified data, SMS/MMS channels, enhanced UI/UX, and powerful integrations.

-

Customer data

Customer dataApple iOS 17 link tracking protection: a marketer’s guide

Read moreLearn all about Apple's iOS 17 update, how its link tracking protection affects digital marketing, and tips to adapt strategies for a privacy-focused future.

Curated content from our newsletters

Tips and tricks

- What is SMS marketing?

- 5 enchanting Halloween email marketing campaign ideas

- 3 tips to nail your D2C marketing strategy

Subscribe now

Your email address will be handled in accordance with our Privacy Policy. We gather data around email opens & clicks using standard technologies including clear gifs to help us monitor and improve our newsletter.

Email marketing best practices

View all-

Email marketing

Email marketingSt. Patrick’s Day email strategies and subject lines

Read moreReady to make your subscribers feel lucky this St. Patrick's Day? Read our blog of email strategy examples and captivating subject lines that will charm your audience.

-

Email marketing

Email marketingEaster marketing: Email, SMS, and subject line ideas

Read moreUnleash your brand's potential this Easter with captivating marketing campaigns. Explore innovative ideas inspired by these email examples, SMS campaigns, and more.

-

Email marketing

Email marketing5 steps towards a successful email marketing campaign

Read moreWant to make your emails stand out? Discover the steps you need to take to make your email marketing campaigns successful.

-

Customer data

Customer dataThe power of preference centers

Read moreDiscover how preference centers can drastically improve your email marketing strategy by respecting customer data privacy, offering personalized experiences for maximum engagement, and conversion.

Free email marketing resources

All blog posts from Dotdigital

-

Industry trends

Industry trendsHow machine learning reads your mind: The personalization power of Spotify playlists

Read moreEver wonder how Spotify crafts those eerily perfect playlists? It's not magic, it's machine learning. Dive into the tech behind your personalized soundtrack and explore Spotify's latest features that take music curation to a whole new level.

-

SMS marketing

SMS marketing5 SMS welcome series messages to hook new subscribers

Read moreInboxes overflowing? Attention spans shrinking? SMS welcome series are your secret weapon. Craft attention-grabbing messages that get seen, leverage sky-high open rates, and turn new subscribers into loyal fans. Learn how with these winning strategies.

-

Automation

AutomationHow to use marketing automation in the financial services industry

Read moreGeneric marketing won't win in the financial services industry. Learn how to engage every customer with personalized messages by using marketing automation.

-

Customer data

Customer dataThe DPDI Bill: What this means for marketers

Read moreDiscover how the DPDI Bill impacts the UK marketing landscape and learn to adapt your strategies for success in this comprehensive guide.

-

Marketing skills

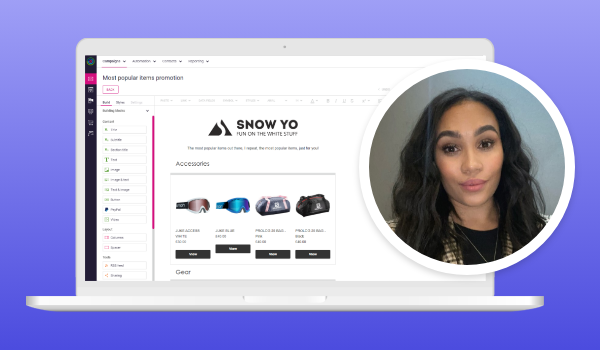

Marketing skillsHow we revived an apparel brand with data-driven marketing

Read moreDiscover how Dotdigital's data-driven marketing tools helped an apparel brand combat declining sales and low engagement by creating personalized and engaging experiences.

-

Automation

AutomationHow to use marketing automation in higher education

Read moreTired of generic brochures and mass emails? Attract top students with engaging journeys using marketing automation. Learn how to nurture leads, streamline workflows, and boost enrollment.

-

SMS marketing

SMS marketingWhy is SMS the perfect addition to any marketing mix?

Read moreElevate your marketing strategy with the power of SMS marketing. Drive sales, increase app downloads, and gather valuable customer feedback.

-

Cross-channel marketing

Cross-channel marketingWhy cross-channel marketing matters

Read moreDiscover the significance of cross-channel marketing in today's digitally driven world. Learn how it can help you connect with customers across their preferred platforms, create personalized experiences, and guide them through their buying journey.

-

International Women’s Day: has it become a sales gimmick?

Read moreIs International Women’s Day becoming little more than another opportunity to sell? How can you plan a IWD strategy that makes a difference? Let's find out.

-

SMS marketing

SMS marketingWhat is MMS and why you should start now

Read moreMMS marketing provides an engaging multimedia experience and enhances your customer engagement. Learn more about how MMS marketing differs from SMS and its benefits for your marketing success.

-

Email marketing

Email marketingSt. Patrick’s Day email strategies and subject lines

Read moreReady to make your subscribers feel lucky this St. Patrick's Day? Read our blog of email strategy examples and captivating subject lines that will charm your audience.

-

SMS marketing

SMS marketingSpaceX Starlink SMS – the final frontier?

Read moreDiscover how SpaceX's Starlink satellite network will revolutionize SMS communication by eliminating black spots and ensuring connectivity even in remote locations.